For professionals who’ve worked in the same industry for years, a change may be in order. Do you identify with any of the following?

For professionals who’ve worked in the same industry for years, a change may be in order. Do you identify with any of the following?

- A lack of purpose and passion

- Working a dead-end job

- No one is investing in you

- Insufficient compensation

If you’re feeling any or all of these symptoms, you may be ripe for a change. The launching pad for this monumental shift? A bit of wisdom from Confucius: “Choose a job you love, and you will never have to work a day in your life.”

Whether you’ve freelanced as a side-gig or are just jumping into the ring, taking on a full-time freelance career is not a decision to be made lightly. Full-time corporate employment offers paid time off for vacations, illness and holidays. Medical, dental, vision, disability and life insurance are often part of a benefits package. So, too, is a guaranteed minimum income.

So, how do you leave all of that security? How do you transition to freelancing as your main source of income? How do you budget and plan? Very carefully.

Be a Business

Transitioning to full-time freelancing means you are going to be a business all on your own. If freelancing is your main source of income, you can’t be casual about it. You’ll have to start thinking like a business owner, even if your only employee is, well, you. By giving up that secure spot in corporate America, you’ve taken on the following roles (in no particular order):

- CEO

- CFO

- Head of Sales & Marketing

- Account Receivable

- IT

- Creative Director

- Writer

- Editor

- Client Services

- and more.

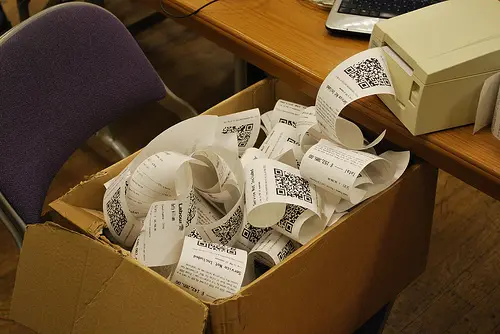

Are you ready and willing to manage both big and small picture details? Gone are the days of throwing receipts into a shoebox. Here are the days of detailed financial record-keeping. Gone are the days of, “Sorry, just saw this email from two weeks ago.” Here are the days of, “Please see attached for all deliverables due tomorrow. Please contact me with any questions.”

Don’t take this to mean you can expense everything and go on a spending spree to outfit a new office. You have to think about overhead costs, billing cycles, positive cash flow and more. Find a reliable and usable accounting platform. Learn it inside and out. Use it.

Research and apply for credit. American Express has some of the best business credit cards with benefits ranging from purchase protection to flexible payment schedules. Using a card (and paying it off monthly) is a great way to keep business expenses separate from personal expenses. It will make it easier for you to reconcile business expenditures by comparing the statement to your accounting records. You’ll also be building credit for your business. That way, if you’re ever in a position to seek out investors or loans for expansion, you’ll have a credit history.

Set Yourself Up for Success

After years of marching to another’s drum beat, it can be tough to stay productive without oversight. By now, you know what helps and hinders your personal productivity. Does a clean workspace keep you sane? Find and maintain a dedicated and orderly space for your business. Using the kitchen table might seem convenient, until someone spills fruit punch all over a very important piece of paper.

Start with a schedule. Until you’ve found your stride, it’s important to commit to a scheduled workday. It doesn’t have to be eight to five, but you must be fully engaged in work during whatever schedule you choose. Don’t let distractions like daytime television destroy your productivity.

If you need Internet to do your job, do you have a plan at home with adequate bandwidth? What happens if you lose access? Do you have a back-up plan? It wasn’t a big deal when your Netflix was down for a few days, but if your livelihood is resting on reliable email access, that changes things.

Network Your Way to Success

Every freelancer wants to be “too busy.” A freelancer’s best problem is having such an overflow of work that turning projects down is necessary. So, how do you get there? You have to make a name for yourself. Relying on a small client base would be nice, but what if the work dries up? Know who you are and what you do. Distill that into an elevator pitch. Imagine this: you run into a friend at a restaurant, and they introduce you to a potential client on the spot. What would you say? Will you have a business card at the ready? You’d better. You don’t have to plaster your face on a billboard like an aspiring realtor. You do need to constantly seek out business opportunities and be ready to pitch yourself at any moment.

Still ready to ditch the suit and forge out on your own? Have fun and stay organized!

This post was written by Amanda Kohn, a bookworm from Phoenix. Although a fashionista at heart, you can find her head in a book or online reading up on the latest headlines. Follow her on Twitter.

Images via ShashiBellamkonda, ben_osteen

Leave a Reply