How much information should you give to your freelance writing clients? This is a question popping up often as more freelance writers launch their careers. Specifically, freelancers are a little wary about giving clients their addresses or social security numbers. I find it interesting, because we have no hesitation when providing these details on a full time job application, doctor’s office form, or when applying for credit. We’re more suspicious of potential clients than we are someone at the mall requesting our details on a credit application in exchange for a free bottle of Pepsi.

Should you give a potential freelance writing client your Social Security Number?

It’s understandable. I don’t give out my social security number to just anyone either. However, clients will need your details in order to take the appropriate action when tax time comes along. Many clients prefer to get this information up front rather than have to scramble at the last minute. Honestly, it’s normal and usually there’s nothing unsavory going on. Still, before you rush over and give a client your first born, be sure the client and the gig are right for you. If your freelance writing client isn’t someone you’d trust with your personal details, he might not be someone you want to work with anyway.

Getting around the Social Security Number issue

Something to consider is to become a Sole Proprieter or LLC so your Social Security Number doesn’t even have to be a factor. You can use your EIN (Employer Identification Number) instead. Also, if you’re not sure if you want to stick with this particular client, or you’re not sure you’re feeling the gig, consider asking him if you can have a 30 or 90 day trial before submitting your private details.

Other considerations:

- How much do you know about your client? Are they upfront with their own details? Before you give anyone your SSN or banking details, make sure you have names, addresses, phone numbers and even an EIN if you can get it. If the client leaves you with no way to get in touch if something bad happens, pass on the opportunity.

- Does the potential client have a good reputation? Research using the web, the Better Business Bureau, past newspapers (in the client’s locale) and other methods. Find out if he or his business has been in the news for scams or fraud.

- What do other writers say? Does this freelance writing client hire other freelance writers? If so, contact them and ask questions. See if you can find former writers and get their opinions as well.

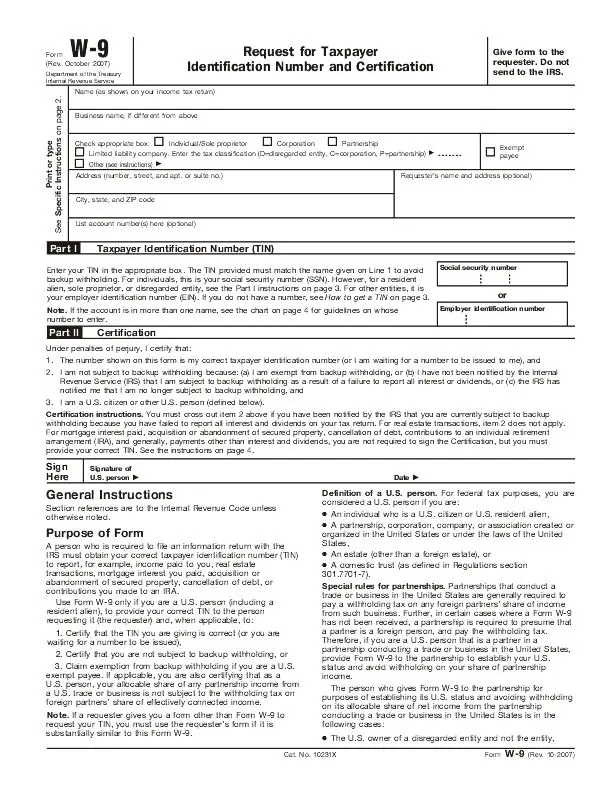

- What type of information does the client want, and why? For example, if the client wants you to fill out a W-9 form, that’s normal, especially if it’s a lucrative project. However, if they request your details in an email, that’s a bit more suspicious. Most clients won’t flat out request your Social. They’ll ask you to complete a @-9 form.

And another thing…

- While it’s normal to want writers to provide addresses or SSNs for tax purposes. You shouldn’t have to provide your Driver’s License ID number, bank details (unless you’re being paid by Direct Deposit), names of the members of your family, school information, information regarding personal habits (unless it pertains to the gig) and any other personal information that is, in essence, none of your client’s business.

Questions to ask:

- Why do you need my social security number (or other private information)?

- Where will you keep this information?

- Is this form encrypted? (hint when using an online form look for “https” rather than “http”.)

- Who else will have access to my information?

- How are you protecting my information?

- What will happen if I don’t provide the required information?

- Can I wait and give you my Social Security Number towards the end of the year after we’ve established a trusted relationship?

Giving a client a social security number does not give them access to your private Social Security records. It only allows them to report your taxes to the IRS. If you’re not sure if you should give up your personal details, ask questions and do your research. If things still smell fishy, pass on the opportunity. Your safety and peace of mind is worth more than a gig.

Know that it’s perfectly normal for a potential client to ask you to fill out forms containing your address and social security number. In most cases there’s nothing to worry about. Most of my clients request this information towards the end of the year, but it’s not unheard of to have a series of forms to fill out once the contract is signed. It’s important to be cautious, but keep in mind refusing to provide those details may mean you have to find a different job.

Keep in mind that if a client is paying by check he’ll need your address, and if he’s paying by Direct Deposit, he’ll need your bank details. As you can imagine, it’s essential to stick with clients you trust off the bat since you’re giving up such important information.

Good luck – and keep asking those important questions!

Have you ever had a request from a potential client that was a bit odd? Tell us about it in the comments.

MNCPQZBZ7WH6

Leave a Reply