In high-stakes industries like insurance, finance, and healthcare, copywriters face a unique challenge: every word must overcome decades of consumer skepticism. One poorly chosen phrase—”comprehensive coverage” without clear exclusions or “affordable rates” buried in fine print—can send potential customers fleeing. This isn’t typical content writing; it’s trust architecture, where language becomes the bridge between complex services and wary consumers.

For freelance writers who master trust psychology, these industries represent one of the most lucrative and impactful niches available. This article explores the specific techniques that turn skeptical readers into confident customers and provides a roadmap for building a portfolio that commands premium rates in sectors where credibility is everything.

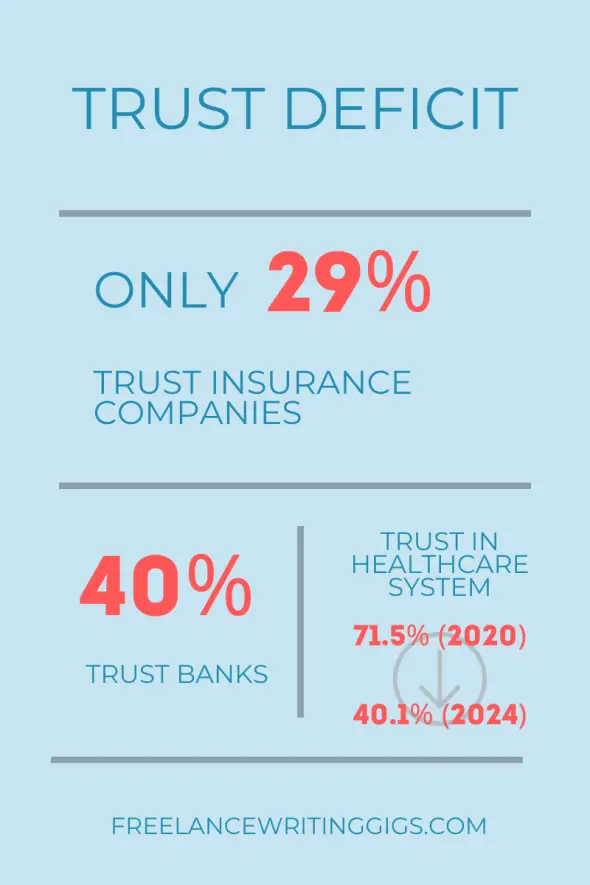

The Trust Deficit Problem

The numbers reveal just how deep the credibility crisis runs. Only 29% of customers trust insurance companies, significantly lower than the 40% who trust banks, while public trust in the U.S. healthcare system plummeted from 71.5% in 2020 to 40.1% in 2024. This trust deficit costs billions in lost conversions and inflated customer acquisition expenses.

The skepticism isn’t unfounded. These sectors carry decades of reputation baggage—insurance claim denials, financial scandals, surprise medical bills. Complex products that consumers struggle to understand get wrapped in regulatory jargon that creates distance instead of connection. When customers can’t decipher what they’re buying, they assume the worst.

This translates directly to business pain. Customer acquisition costs in financial services run 3-5x higher than consumer goods, while conversion rates hover in single digits. The compound effect makes it worse: Distrust spreads through word-of-mouth and online reviews faster than any marketing campaign can counter it.

Yet this crisis creates unprecedented opportunity for companies—and writers—willing to communicate differently. Disruptors like ACKO are proving that radical transparency works. Zero commissions, instant settlements, and copy that sounds refreshingly human can transform skeptical browsers into confident customers. When transparency becomes your competitive advantage, trust-building copywriters become invaluable strategic partners.

The Trust-Building Copywriting Toolkit

When skepticism is your starting point, traditional marketing tactics backfire. Trust-building copy requires a fundamentally different approach—one that acknowledges doubt, addresses concerns head-on, and proves credibility through evidence rather than claims.

Radical Transparency Techniques

“Show, don’t claim” becomes your golden rule. Instead of “We’re the best insurance company,” write “4.7⭐ rating from 500,000+ customers with 96% claims approval rate.” Numbers beat superlatives every time because they’re verifiable.

Admit limitations upfront before customers discover them. Copy for a health insurance company could be something like this: “This plan doesn’t cover cosmetic procedures, fertility treatments, or experimental treatments. Here’s exactly what IS covered…” This counterintuitive approach builds trust because it signals honesty about everything else.

Process transparency demystifies complex procedures. Rather than writing “We handle claims quickly,” explain:

“Here’s exactly how your auto claim gets processed:

1. Submit photos via our app

2. Automated damage assessment within 5 minutes

3. Approval notification via text

4. Direct deposit within 24 hours.”

Transparency removes fear of the unknown.

Pricing clarity means genuinely meaning “no hidden fees.” Copy for a financial advisor might be: “Total annual fee: 0.75% of assets under management. No trading fees, no account minimums, no surprise charges. Period.”

Social Proof That Actually Proves

Customer stories need specific details and measurable outcomes. Instead of “Great service!” use “Filed my roof damage claim on Tuesday morning, had a $12,000 check deposited by Thursday afternoon.”

Real numbers provide concrete proof: “Average claim processed in 2.3 business days” or “98.4% customer retention rate based on 25,000 policy renewals.” Make metrics verifiable and recent.

Specificity implies authenticity.

Additionally, peer testimonials trump celebrity endorsements in trust-dependent industries. A regular customer saying, “First time an insurance company actually kept their promises” resonates more than any paid spokesperson.

Third-party validation carries more weight than self-promotion. Display ratings from Better Business Bureau, Trustpilot, or industry bodies prominently. If you’re writing for a medical practice, you can highlight something like “Joint Commission Accredited” or “5-star CMS rating.”

Language That Lowers Defenses

Conversational tone dismantles corporate barriers. Write “We know medical bills can be overwhelming” instead of “Our comprehensive healthcare solutions optimize patient financial outcomes.”

Speak human, not corporate.

“You” language puts customers first: “Your surgery is pre-approved within 48 hours…” rather than “Our system processes pre-authorizations…” This subtle shift makes copy feel personal rather than procedural.

Avoid jargon or explain it immediately. When technical terms are necessary, follow with plain English: “Deductible (the amount you pay out-of-pocket before your coverage begins).”

Questions acknowledge real concerns: “Worried your claim will get denied? Here’s our 94% approval rate and the top 3 reasons why the other 6% don’t qualify.” Addressing fears directly shows you understand customer anxiety.

Credibility Markers in Copy

Professional credentials and team expertise build confidence. Say you’re writing for a financial planning firm, you can note: “Our certified financial planners average 15+ years experience, with $2.8 billion in client assets under management.”

Industry experience and track record provide foundation: “Serving families since 1987” or “Processed over $500 million in claims with 99.1% accuracy rate.” Historical performance predicts future reliability.

Security certifications and compliance mentions are especially crucial in finance and healthcare. Display “FDIC Insured,” “HIPAA Compliant,” or “SOC 2 Type II Certified” prominently where relevant.

Partnership logos signal institutional trust. If major hospitals, banks, or Fortune 500 companies work with you, showcase those relationships: “Trusted by Kaiser Permanente, JPMorgan Chase, and 500+ healthcare systems nationwide.”

Portfolio Building for High-Trust Industries

You’re probably chomping at the bit, wanting to get into this writing niche by now. Quiet understandably! The earning potential and impact are compelling, but breaking into high-trust industries requires a strategic portfolio approach that proves you understand their unique challenges. How do you do this?

Essential Portfolio Pieces

Your portfolio must prove you understand the unique challenges of trust-dependent industries. Include before/after examples showing how you transformed corporate jargon into transparent communication—like rewriting “comprehensive coverage with standard exclusions” into “covers collision, theft, and weather damage; doesn’t cover racing, intentional damage, or wear-and-tear.”

Case studies with measurable results carry enormous weight. Document improvements like “Rewrote insurance FAQ page, increased quote completions by 34%” or “Simplified medical consent forms, reduced patient callback questions by 60%.”

Showcase samples across different trust-building formats: FAQ sections that address real concerns, testimonial templates that capture specific outcomes, process explanations that demystify complex procedures, and compliance-friendly copy that satisfies legal requirements without sounding robotic.

Demonstrating Trust Expertise

Prove you understand industry regulations and limitations. A healthcare writing sample might acknowledge HIPAA restrictions while still being engaging. Financial services copy should demonstrate knowledge of SEC guidelines for investment disclaimers.

Show your ability to simplify complex concepts without misleading customers. This means explaining insurance deductibles clearly without oversimplifying coverage limitations, or describing investment risks honestly without scaring away potential clients.

Build a track record with sensitive topics like medical procedures, insurance claims processes, or financial planning fees. These high-stakes subjects require writers who can balance transparency with tact.

Pricing Premium for Trust Work

Higher stakes justify higher rates. When your copy handles customer life savings, health decisions, or insurance claims, charge accordingly. These industries typically have larger budgets and understand that poor communication costs far more than premium copywriting. For example, insurance copywriters typically charge hourly rates ranging from about $27 to $96, reflecting the specialized nature of the work. This can go up for highly experienced writers and more complex projects.

Factor in compliance review requirements. Your copy may need legal approval, multiple stakeholder sign-offs, and ongoing updates as regulations change. This additional complexity and responsibility warrant premium pricing that reflects the specialized expertise required.

Start Your Trust-Building Writing Career Now

In industries where consumer skepticism runs deeper than ever, the ability to build trust through words has become a competitive necessity. While most sectors compete on price or features, insurance, finance, and healthcare companies compete on credibility—and those that master transparent communication are winning market share from competitors still hiding behind corporate speak.

The opportunity for freelance writers is significant: companies desperately need writers who understand trust psychology, can navigate regulatory requirements, and can transform complex services into clear, honest communication that converts skeptical prospects into confident customers.

Stop waiting for the perfect moment to enter this specialized niche. Your trust-building writing career begins with three concrete steps you can take:

Week 1: Choose your battleground—insurance, financial services, or healthcare—and create three portfolio samples that showcase trust-building mastery. Rewrite a confusing insurance FAQ into clear, honest answers. Transform a bank’s corporate jargon into plain English that actual humans understand. Simplify a medical consent form without losing legal protection. These samples become your proof of concept.

Week 2: Hunt for companies whose current copy screams “trust deficit.” Visit insurance websites that bury important information in fine print, financial advisors who speak only in buzzwords, or healthcare practices with intimidating forms. Document specific problems you could solve, then craft personalized outreach emails showing exactly how you’d improve their communication.

Week 3: Start pitching with confidence. The companies that solve their trust deficits first will dominate the next decade, and they need writers who understand that transparency isn’t just good ethics—it’s profitable business strategy. Your expertise in trust psychology positions you as a strategic partner, not just another copywriter.

The trust revolution is already underway—the only question is whether you’ll be writing it or watching from the sidelines. Your first client is just one honest, compelling sample away.