The benefits of being your own boss outweigh the advantages of working a 9 to 5 job – we’ve already established that. Sometimes, though, we might forget that there are certain responsibilities attached to being a freelancer. For sure, we KNOW these responsibilities are there, but especially for those new to the freelance business, little things might slip by you every now and then.

The benefits of being your own boss outweigh the advantages of working a 9 to 5 job – we’ve already established that. Sometimes, though, we might forget that there are certain responsibilities attached to being a freelancer. For sure, we KNOW these responsibilities are there, but especially for those new to the freelance business, little things might slip by you every now and then.

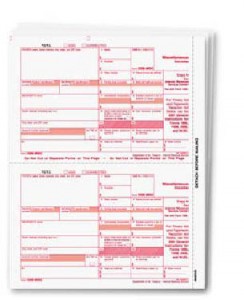

When it comes to taxes, the need to track your income is paramount. After all, how will you be able to declare your income and compute taxes accurately if you do not follow some one system or another?

This post is the result of a comment I saw on some forum regarding one woman talking about a client who forgot to send in his 1099 before tax time. As a result, she forgot to declare that as part of her income. The job was a one-time deal done at the beginning of the previous year, explaining the lapse. For many freelancers, one-time deals are not that uncommon, and if you are not careful, you might find yourself facing a similar situation as the one I just described.

You may be thinking, so what? Well, this just might bite you in the butt later on, when the IRS sends you a revised tax statement. If it’s a small job and it’s just one, then no worries. However, if you neglect to declare a considerable amount (or several jobs amounting to a lot of money), then you’ll end up having to pay maybe several hundreds more.

So how do you track your income?

Obviously, this depends on your personal preference. I suggest keeping separate files for different items such as receipts, bank statements, invoices, etc. Whether you use a box, a filing cabinet, an expandable folder, an Excel file, or some other software, it doesn’t matter. The bottom line is that your filing system will help you NOT to overlook any income that you make so that when you declare your taxes, you can be as error-free as possible.

FWJ readers, care to share your income tracking system with us?

Leave a Reply