When you’re self-employed, you’re the boss, the employee, and the safety department all rolled into one. You get to choose your clients, set your schedule, and build a career on your own terms—which is amazing, right?

But let’s be real: That freedom also means you don’t have paid sick days, company insurance, or an HR team waiting to help when things go sideways. If you can’t work, the income stops. Simple.as.that.

That’s where a safety net comes in. It’s not about being paranoid or planning for disaster—it’s about giving yourself some breathing room when life happens. A solid safety net keeps your independence from turning into instability, and it doesn’t require a finance degree or a giant savings account. You just need a few smart systems that protect you when work slows down or an unexpected expense hits.

Let’s start with the first step: figuring out what could actually knock your freelance business off balance.

Start with Risk Awareness

Ask yourself: What could go wrong?

Before you build your safety net, take a minute to look at what you’re really protecting yourself from.

What would happen if your laptop died tomorrow?

Or if a client disappeared without paying?

Maybe you get sick, or family responsibilities pull you away from work for a few weeks.

When your income depends on you showing up, even a small setback can cause a big ripple.

One of the easiest ways to start protecting yourself is with basic insurance coverage. Even a simple term plan can give you peace of mind that your family will be financially secure if something happens to you. Think of it as the first layer in your safety net—a small, affordable step that buys you stability while you build the rest.

Once you’ve got a clear picture of your risks, you can start layering in other forms of protection—steady income, savings, and support systems—that keep your freelance life secure no matter what comes your way.

Create a Consistent Income Base

The first “real” layer of your safety net is consistency. You can’t save, plan, or invest confidently if your income looks like a roller coaster. As a freelancer, you’ll always have some ups and downs, but you can smooth out the ride by building a more predictable base.

Start by identifying your minimum monthly number—the amount you need to cover essentials like rent, utilities, groceries, and insurance. Once you know that baseline, you can focus on securing steady work that meets it. Retainer clients, ongoing contracts, or part-time arrangements can all help create a dependable income floor.

If your work is purely project-based, try setting up a “stability system.” That might mean saving a percentage of every payment (say, 20%) into a business buffer account or scheduling your pitches regularly so there’s always something in the pipeline. Even automating small transfers to savings after each invoice can make a big difference.

The goal isn’t to eliminate the natural ebb and flow of freelancing—it’s to make sure those dips don’t derail you. A little consistency today means a lot more security tomorrow.

What’s that saying? Slow and steady wins the race.

Separate Safety Accounts for Stability

Once your income is a bit more predictable, the next step is organizing it. Keeping everything in one account makes it too easy to lose track of what’s “extra” and what’s spoken for. Instead, think of your money in buckets—each one with its own purpose in your safety net.

Start with three basic accounts:

1. Emergency fund: This is your true backup—money you don’t touch unless things go wrong. And I mean, don’t touch! Aim for at least three to six months of essential expenses, or more if your income is irregular.

By the way, “things going wrong” does not mean you’re eyeing that new MacBook even if your current one is perfectly fine, but “could use an upgrade.” It’s not for slow months, impulse gadgets, or a spontaneous beach trip to clear your head. This is break-glass-in-case-of-emergency money—laptop died, you’re sick for weeks, or your biggest client suddenly disappears kind of money. The real stuff.

2. Tax fund: Set aside around 25–30% of every payment for taxes. You’ll thank yourself later when deadlines roll around. After all, there are only two things in life that are certain: Death and Taxes.

3. Business buffer: This is your short-term safety net for late payments or slow months. Even a few hundred dollars can help you avoid panic when a client misses an invoice deadline.

If you can, keep these funds separate from your main checking account. Out of sight, out of temptation. High-yield savings accounts are perfect for this—your money stays accessible but earns some interest while you wait.

It’s not about having thousands saved right away. It’s about building habits that make your money work for you, instead of the other way around. Every automatic transfer is another thread in your safety net.

Protect Yourself with Insurance

No safety net is complete without protection from the unexpected—and that’s where insurance comes in. As a self-employed person, you don’t have an employer offering benefits, so it’s up to you to make sure you’re covered when life throws a curveball.

So, addressing the elephant in the room: Insurance has somewhat of a negative rep. Still, trust and believe, when you don’t have it, you’ll end up needing it!

Start with the basics: health insurance. One medical emergency can wipe out your savings faster than you can say “invoice overdue.” Even a basic plan helps protect your finances from sudden medical bills.

Next, think about life insurance,—especially if you have dependents or loved ones who rely on your income. A good option to look into is a term plan. It’s affordable, straightforward, and designed to provide financial protection for your family if something happens to you during the policy term. Unlike more complex insurance types, term insurance focuses purely on security—no frills, no hidden extras.

Don’t forget disability insurance, either. If you can’t work due to illness or injury, this coverage can replace part of your income so you’re not forced to drain your emergency fund or take on debt.

Insurance isn’t the most exciting topic, but it’s one of the smartest ways to make your freelance life sustainable. You can’t predict the future—but you can plan for it.

Diversify Your Income Streams

Relying on one client or one kind of work is like walking a tightrope without a net. You might be fine for a while, but one wobble (a budget cut, a ghosted invoice, or an AI-powered rewrite) can throw everything off. A stronger approach? Build multiple income streams that complement your writing business and create long-term stability.

Start by expanding within your comfort zone, then branch out strategically.

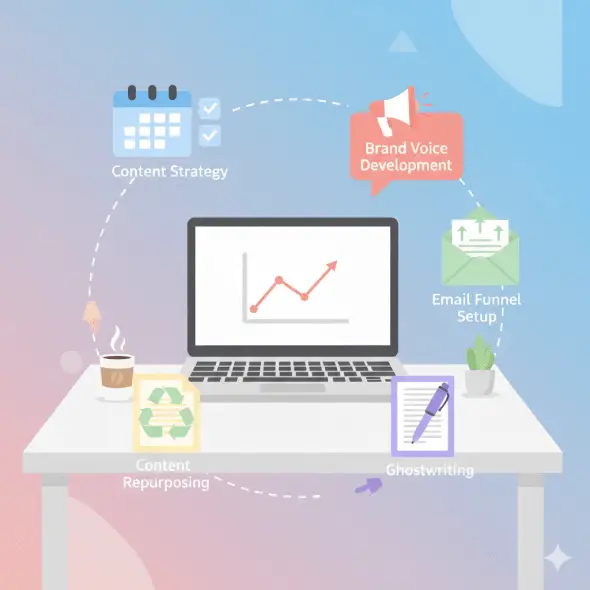

Adjacent Services You Can Offer

As a writer, your skill set already translates to other high-value services. Here’s a quick list of ideas:

- Content strategy: Help clients plan what to publish, where, and why. You can offer audits or monthly retainers for content calendars.

- Brand voice development: Create messaging guides for small businesses or startups that don’t have in-house marketing teams.

- Email funnel setup: Go beyond writing emails—help set up the automation and segmenting in tools like ConvertKit or MailerLite.

- Ghostwriting thought leadership posts: Executives, coaches, and consultants will pay for polished LinkedIn or Medium content that sounds like them but reads better.

- Content repurposing: Turn one long-form blog post into social captions, newsletter snippets, and short videos—clients love efficiency.

Create Courses and Workshops

Freelancers who teach what they know often build the most reliable secondary income. Instead of generic “how to freelance” topics, focus on niche, experience-based offerings like:

- “Pitch Like a Pro: Landing Clients in Competitive Niches” – A course on crafting irresistible pitches with real examples

- “From Article to Ebook: Expanding Your Writing Income” – Teaching writers how to turn client work into publishable assets

- “The SEO Sprint: Learn Keyword Research in 2 Weeks” – A time-bound, high-value mini course for writers who want results fast

- “The One-Person Content Studio” – A workshop for freelancers ready to package writing, editing, and strategy as a single offer

- “Freelance Systems 101” – Teach organization: contracts, invoicing, time management, and client communication workflows

You can host your course or workshop on platforms like Podia, Teachable, or Thinkific, or sell through Gumroad if you prefer simplicity and direct control. Want a more casual, interactive approach? Try live cohorts on Zoom, or even offer paid workshops via Eventbrite or LinkedIn Events.

Passive and Scalable Options

Once you’ve got solid material, record it and turn it into an evergreen product. Pair your lessons with downloadable templates or checklists. You can also:

- Sell writing tools, templates, or Notion dashboards for freelancers.

- Create a Patreon or Substack where paying subscribers get bonus tips, templates, or private AMAs.

- Partner with SaaS tools (grammar checkers, scheduling apps, portfolio platforms) for affiliate commissions.

The goal isn’t to pile on more work—it’s to spread your risk and build assets that earn even when you’re not writing. Think of each new stream as another line in your safety net: strong, flexible, and ready to catch you when freelance life gets unpredictable.

Build a Reliable Support System

Freelancing can feel like a solo act, but no one builds a sustainable career completely alone. Your support system—the people, tools, and professional relationships you lean on—plays a big part in how strong your safety net really is.

No freelancer is an island, no matter how introverted you may be.

Start with your professional circle. Connect with other freelancers who understand the ups and downs of self-employment. Join writing communities on platforms like LinkedIn, Slack groups, Discord servers, or Facebook groups for freelance writers. Not only can these spaces help you find gigs, but they’re also great for sharing advice on rates, taxes, and client red flags.

If you can, find a mentor or accountability partner. This could be another writer who checks in monthly, or a small mastermind group where you set goals, swap feedback, and keep each other moving forward. Having people who understand your challenges helps you stay focused when things get chaotic (and celebrate when they go right).

Next, think about your professional safety net—the experts who keep your business running smoothly:

- An accountant who understands freelance taxes and can help you maximize deductions

- A lawyer or legal service that can review your contracts and protect you from scope creep or late payments

- A virtual assistant (even part-time) who can handle admin tasks so you can focus on billable work

And don’t underestimate the importance of emotional and personal support. Freelancing can get lonely or stressful, especially when work slows down. Having friends, family, or a therapist who understands the pressures of self-employment can make the tough days easier to handle.

Your safety net isn’t just financial—it’s human. The right people and systems help you stay resilient, grounded, and ready for whatever freelancing throws your way.

Your Action Steps

You don’t have to overhaul your freelance life overnight. Just start with a few small, practical moves that will make you feel more secure right away. Here’s what you can do to start building your safety net.

✅ Calculate your “bare minimum” income. Write down your essential monthly expenses—rent, food, utilities, insurance—and divide by four. That’s the amount you need to earn each week to stay stable.

✅ Open one new account. Whether it’s for taxes, emergencies, or a business buffer, separate one piece of your income so you can start saving with intention.

✅ Research insurance options. Spend 15 minutes learning about term insurance or income protection plans.

✅ Follow up with two clients. Reach out about a retainer, an ongoing project, or new opportunities. Consistent work is the backbone of your safety net.

✅ List one new income idea. Maybe it’s an ebook, a freelance workshop, or content strategy services. Pick one and sketch out your first step.

✅ Join one freelance community. Find your people—writers who share advice, leads, and encouragement. The right network keeps you grounded and motivated.

Start with one or two this week and then continue down the list. My challenge to you is to tick all of the above before the year ends!

Each of these steps takes less than an hour, but together they form the foundation of your freelance safety net. The goal isn’t perfection—it’s progress. Every small decision you make this week strengthens your future stability and gives you one more reason to feel confident in the unpredictable, rewarding life you’ve built as a freelancer.

I’ll leave you with this: Security isn’t the opposite of freedom—it’s what lets you enjoy it.